Understanding the 2025 Social Security COLA Increase

The Social Security Cost-of-Living Adjustment (COLA) is an annual increase in benefits for Social Security recipients, designed to help maintain the purchasing power of their benefits in the face of inflation. The COLA is calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures the average change in prices paid by urban wage earners and clerical workers for a basket of consumer goods and services.

Factors Contributing to the COLA

The COLA is calculated based on the percentage increase in the CPI-W from the third quarter of the previous year to the third quarter of the current year. This means that the COLA is not necessarily based on the inflation rate for the entire year, but rather on the change in inflation over a specific period.

The Current Economic Climate and its Potential Impact on the 2025 COLA

The current economic climate is characterized by high inflation, which is likely to have a significant impact on the 2025 COLA. The Federal Reserve has been raising interest rates in an effort to combat inflation, but it is unclear how effective these measures will be. If inflation remains high, the 2025 COLA could be substantial. However, if inflation begins to moderate, the COLA could be lower.

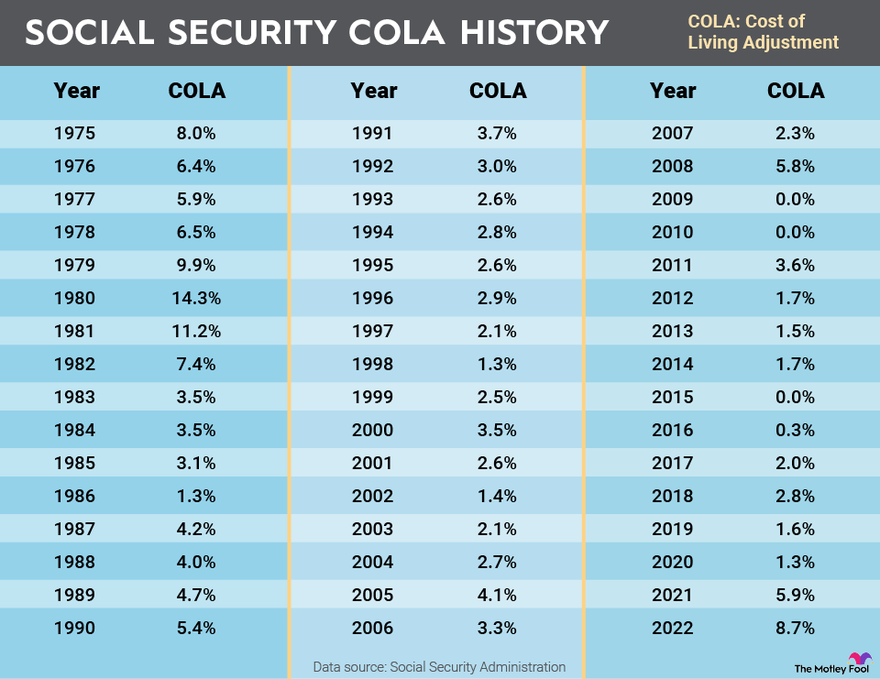

Historical Overview of Social Security COLA Increases

The Social Security COLA has varied significantly over the years, reflecting changes in the rate of inflation. In some years, the COLA has been substantial, while in other years it has been modest or even nonexistent. For example, the COLA was 5.9% in 2023, the highest increase in over 40 years, reflecting the high rate of inflation at the time. However, in 2016, the COLA was only 0.3%, the smallest increase since 1983, due to low inflation.

The Social Security COLA is a critical component of the Social Security program, providing a vital safety net for millions of Americans. The 2025 COLA will be determined by the rate of inflation in the coming months, and it is likely to be influenced by the ongoing economic uncertainty.

Potential Implications of the 2025 COLA Increase

The projected Social Security cost-of-living adjustment (COLA) for 2025 is a significant event that will have far-reaching implications for millions of beneficiaries, the Social Security trust fund, and the broader economy. Understanding the potential impact of this increase is crucial for policymakers, beneficiaries, and stakeholders alike.

Impact on Beneficiary Purchasing Power

The COLA increase aims to protect the purchasing power of Social Security beneficiaries by adjusting their benefits to keep pace with inflation. A higher COLA would provide beneficiaries with more financial resources to meet their essential needs, such as food, housing, and healthcare. However, the effectiveness of the COLA in maintaining purchasing power depends on several factors, including the accuracy of the inflation measurement used to calculate the COLA and the relative price changes of goods and services that beneficiaries consume.

Effects on the Social Security Trust Fund

The Social Security trust fund is financed through payroll taxes. A higher COLA would lead to increased benefit payments, which would draw down the trust fund balance at a faster rate. This could accelerate the projected date when the trust fund is projected to become depleted, potentially leading to benefit cuts.

The Social Security Administration projects that the trust fund will be depleted by 2034.

Stakeholder Perspectives on the COLA Increase

Different stakeholders have varying perspectives on the implications of the COLA increase.

- Beneficiaries generally welcome the COLA increase as it provides them with much-needed financial relief. A higher COLA would help them maintain their standard of living and meet their essential needs.

- Policymakers face a complex balancing act. They must consider the needs of beneficiaries while also ensuring the long-term sustainability of the Social Security program.

- Economists offer diverse perspectives on the COLA increase. Some argue that a higher COLA could stimulate the economy by increasing consumer spending. Others caution that it could exacerbate inflation or strain the Social Security trust fund.

Future Projections and Considerations

The 2025 Social Security COLA increase is calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures changes in the cost of living for urban wage earners and clerical workers. The increase is determined by the percentage change in the CPI-W from the third quarter of the previous year to the third quarter of the current year. While this methodology provides a relatively straightforward way to adjust benefits for inflation, it has certain limitations.

Methodology and Limitations

The CPI-W is a broad measure of inflation and may not accurately reflect the specific spending patterns of Social Security beneficiaries. For instance, beneficiaries may have different spending priorities than the average urban wage earner and clerical worker, and the CPI-W may not fully capture changes in the cost of healthcare, housing, and other expenses that are particularly important to older adults. Additionally, the CPI-W is based on a fixed basket of goods and services, which may not adequately account for changes in consumer preferences or the availability of new products and services.

Factors Influencing Future COLA Increases, 2025 social security cola increase

Several factors can influence future COLA increases, including:

- Inflation: Inflation is the primary driver of COLA increases. Higher inflation rates generally lead to larger COLA increases. Conversely, lower inflation rates can result in smaller or even no increases. The Federal Reserve’s monetary policy, global economic conditions, and supply chain disruptions can all contribute to inflation.

- Economic Growth: Economic growth can impact COLA increases indirectly through its effect on inflation. Strong economic growth can lead to higher inflation, while weak economic growth can lead to lower inflation. However, the relationship between economic growth and inflation is not always straightforward and can be influenced by other factors.

- Demographic Changes: Demographic changes, such as an aging population and increased life expectancy, can also influence COLA increases. As the population ages, the number of Social Security beneficiaries increases, putting pressure on the program’s finances. To maintain the solvency of the program, policymakers may need to consider adjustments to benefits, including COLA increases.

Projected COLA Increase

The following table compares the projected 2025 COLA increase to historical averages and potential future scenarios:

| Scenario | Projected COLA Increase |

|---|---|

| Historical Average (1975-2024) | 3.3% |

| 2025 Projection | 3.8% |

| High Inflation Scenario (4% CPI-W growth) | 4.5% |

| Low Inflation Scenario (2% CPI-W growth) | 2.5% |

The 2025 COLA increase is projected to be 3.8%, which is slightly higher than the historical average of 3.3%. However, the actual increase could vary depending on future economic conditions and inflation rates.

The 2025 Social Security COLA increase is a crucial topic for many, especially as we face rising costs and economic uncertainty. While the focus is on the financial implications, we can’t ignore the potential impact of unforeseen events like ground stop nyc airports , which can disrupt travel plans and add further strain on our budgets.

Understanding these challenges is essential as we navigate the future of Social Security and its role in our lives.

The 2025 Social Security cost-of-living adjustment (COLA) will be determined by the Consumer Price Index (CPI) for Urban Wage Earners and Clerical Workers (CPI-W) in the third quarter of 2024. This adjustment is crucial for many seniors, helping them maintain their standard of living.

While navigating the complexities of financial planning, it’s worth remembering the timeless elegance of craftsmanship, such as that found in Carolina Chair and Table , a company dedicated to creating furniture that lasts for generations. Just as these handcrafted pieces offer enduring value, the Social Security COLA seeks to provide financial stability and peace of mind for those who have earned it.